We may earn money or products from the companies mentioned in this post, and as an Amazon Associate I earn from qualifying purchases. Please see my full disclosure for more information.

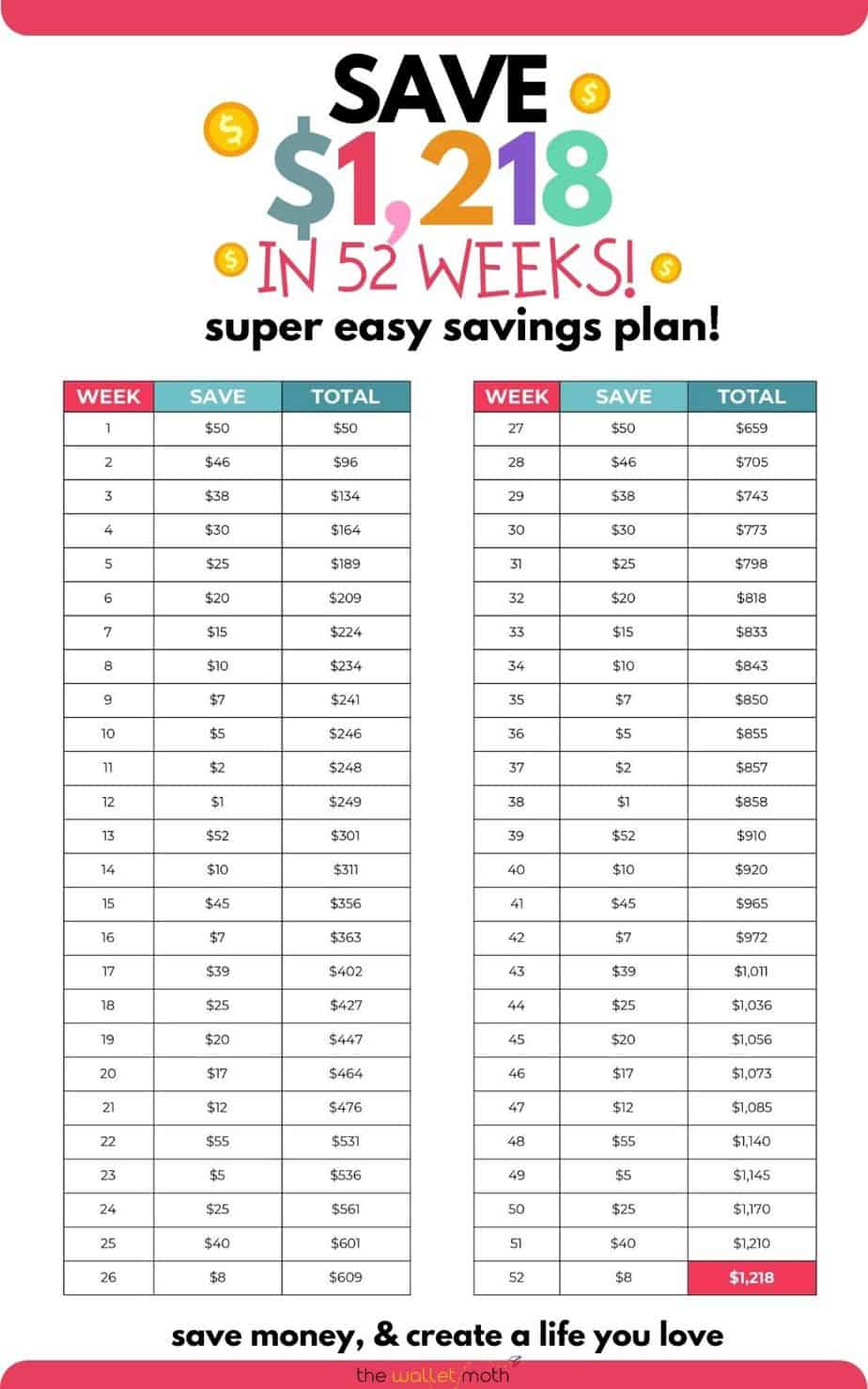

A 52-week money saving challenge designed to make saving an extra $1,200 simple, and easy to accomplish without even thinking about!

How to save over $1,200 extra in 52-weeks with this money saving challenge

Do you struggle to put cash away on a regular basis each month? If you’re not already in that habit, it can be difficult to find the extra cash to put away each week without really missing it.

This 52-week savings challenge is designed to make saving an easy, systematic process, leaving you with an extra $1,218 at the end of the challenge.

How to free up the cash in your daily spending?

It’s surprising how many small spending habits can really add up over the month. It sounds cliche to blame a takeout coffee, a dinner out, and maybe a night out at the pub with friends for your low bank balance, but if you’re not really aware of how much spending each month, it can really surprise you how quickly those small costs add up.

The most important way to free up cash in your daily spending is to:

- Start being more aware of what you are spending your money on: You could go as far as to track your expenses one month using a money tracker or a spreadsheet, or just simply be more aware and mindful of what you are spending on.

- Set some goals for yourself: Set some realistic, measurable savings goals for yourself. Not simply ‘to have more money’ but to save a certain amount in X amount of time, saving for a certain reason (house deposit, holiday, emergency fund…).

This 52-week money saving challenge is designed to help you have a goal in mind. A goal of $1,218, to be precise.

THE 52-WEEK SAVING CHALLENGE

Download your printable version of this 52-week money saving challenge & get access to all other The Wallet Moth freebies.

You can start this money saving challenge at any point in the year – just assign ‘week one’ as the week you’re starting. At the end of this challenge, you’ll have an extra $1,218 in your savings account.

You could use this challenge purely to save, or even to save extra on top of what you already have going into your savings account.

7 Ways To Save More This Year

So, you’ve got your challenge and you’ve got your goal. Now, how to free up some cash in your daily life to make sure you can actually complete this challenge? Below are some simple yet genius money saving tips to help you get started.

1. Limit your ‘mindless’ spending

By mindless spending, I mean the things like popping out to grab a coffee when you could make a perfectly good one at home, grabbing a drink and a snack from the shop (when, again, you could probably wait 30 minutes until you get home), getting an Uber instead of walking or taking public transport, buying an item of clothing just because you’re bored rather than really wanting it etc.

Often, if we’re not in a saving mindset, these small purchases seem like no big deal at the time – but they quickly add up over the month when that money could be going in your savings account with a little more effort.

2. Start meal prepping healthy (and cheaper) meals

Food can be a huge money drain if you’re accustomed to eating out and don’t really know how to cook cheap and healthy meals for yourself.

Gaining the skill of nutritious meal prep can life-changing: for your wallet, sure, but also for your health and well-being.

I’ve got numerous guides to meal prepping on a budget on this site, which you can check out here:

- How To Meal Prep On A Budget + 30 Cheap Meal Prep Ideas

- 120+ Vegan Meal Prep Ideas That Take 30 Minutes Or Less

- Plant Based On A Budget: Grocery List, Cheap Vegan Recipes & More

3. Invest in reusable items to save money long-term

Re-usable items well-worth the investment include:

– a water bottle,

– metal straws,

– Tupperware,

– muslin cloths or reusable cotton pads,

– shopping bags,

– cloths instead of paper towels,

– silicone baking mats

And so many more. Think about all the single-use products you have at home that you buy, use, then throw away. Then imagine how much you could save by having reusable items to simply wash, dry, and use again instead!

The long-term savings could go up into the hundreds if not thousands!

4. Think about the home costs you could cut down on

I saved a lot of money when I decided not to get a cable deal with my broadband provider, and instead have just stuck to having Netflix and Amazon Prime (~$15 a month tops).

These two streaming services have enough on them to be happy with one or the other, but I love Netflix and I use Amazon often enough that the Prime subscription is really worth it!

Compared to a cable provider, you could save thousands in a year by simply cutting out the cable.

Want to go even further? Say goodbye to TV altogether and start reading – audiobooks are the cheapest option you can get, but kindle books are also extremely affordable and a great way to pass the time more productively in the evenings.

5. Consider building some minimalist habits

Minimalism goes a long way towards helping you save money and be more mindful in general about your goals and what you want to direct your finances towards.

Considering building some minimalist habits and cultivating more of a minimalist mindset could be a huge help if you are looking to be better at saving money long-term.

6. Start thinking frugally

Likewise, start thinking about living more frugally in general. Frugal living is about spending smarter, not necessarily less and is a game-changer when it comes to saving more money on a regular basis.

This article on how to be frugal with over 45 ideas and tips is a great place to start!

7. Shop own-brand names

What’s the difference between a store’s own branded packet of tortilla chips, and that big international brand that you see plastered all over the adverts?

Nothing but the packaging.

Seriously – most of the money you pay for a more high-end, branded product is because of the packaging. The actual food itself is almost identical – so save your money, shop own-brand produce, and eat like a king!

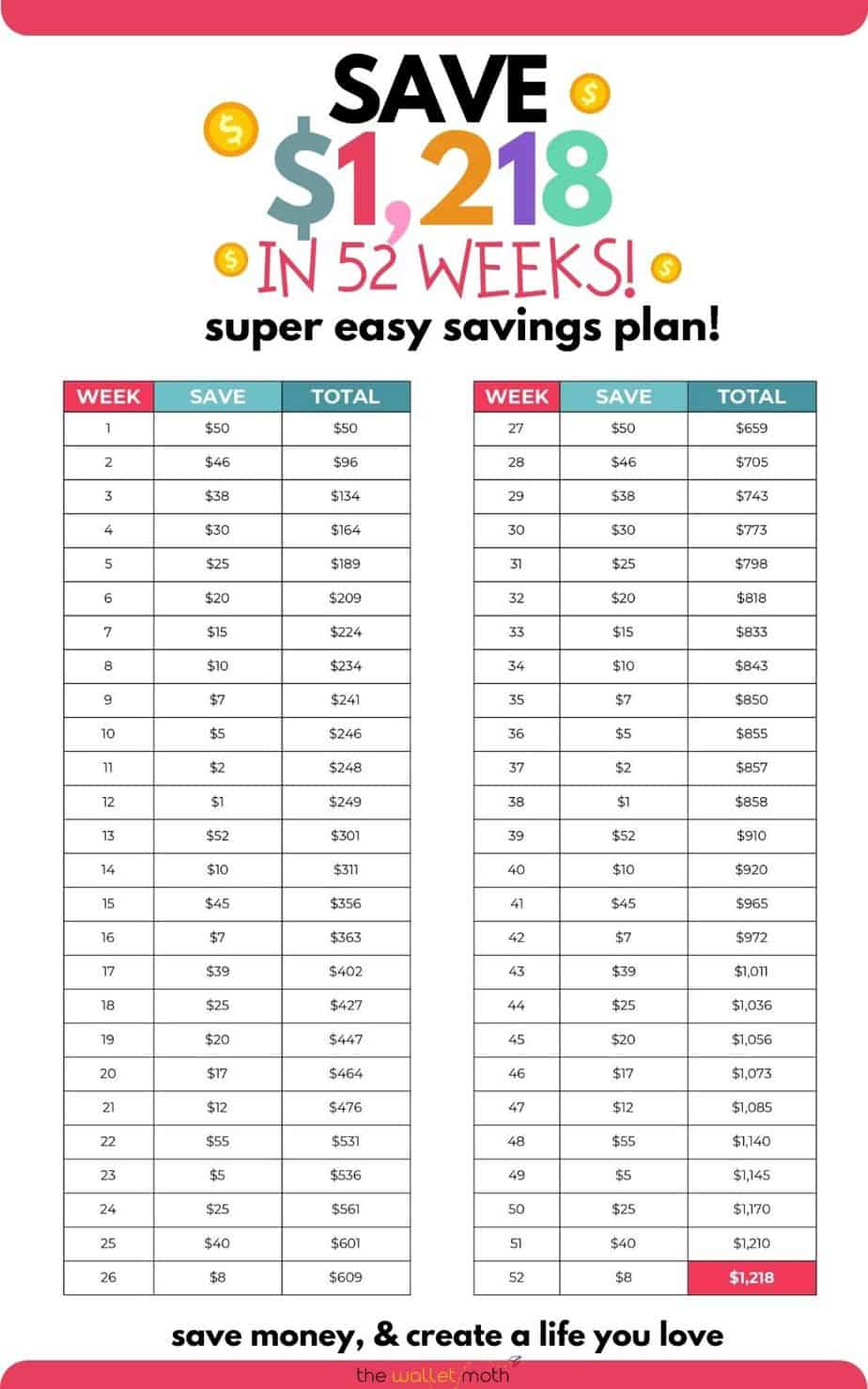

THE 52-WEEK SAVING CHALLENGE

Download your printable version of this 52-week money saving challenge & get access to all other The Wallet Moth freebies.

Start saving today

Hopefully, the list above has given you a few ideas for ways you can make some room in your budget to successfully complete this money saving challenge.

What will you do with an extra $1,218 next year? If you have a partner, see if you can get them involved too, and between you save over $2,400!

Let me know how you get on – looking forward to seeing you on this journey!

Read the ultimate list of over 25 legitimate ways to make money online!